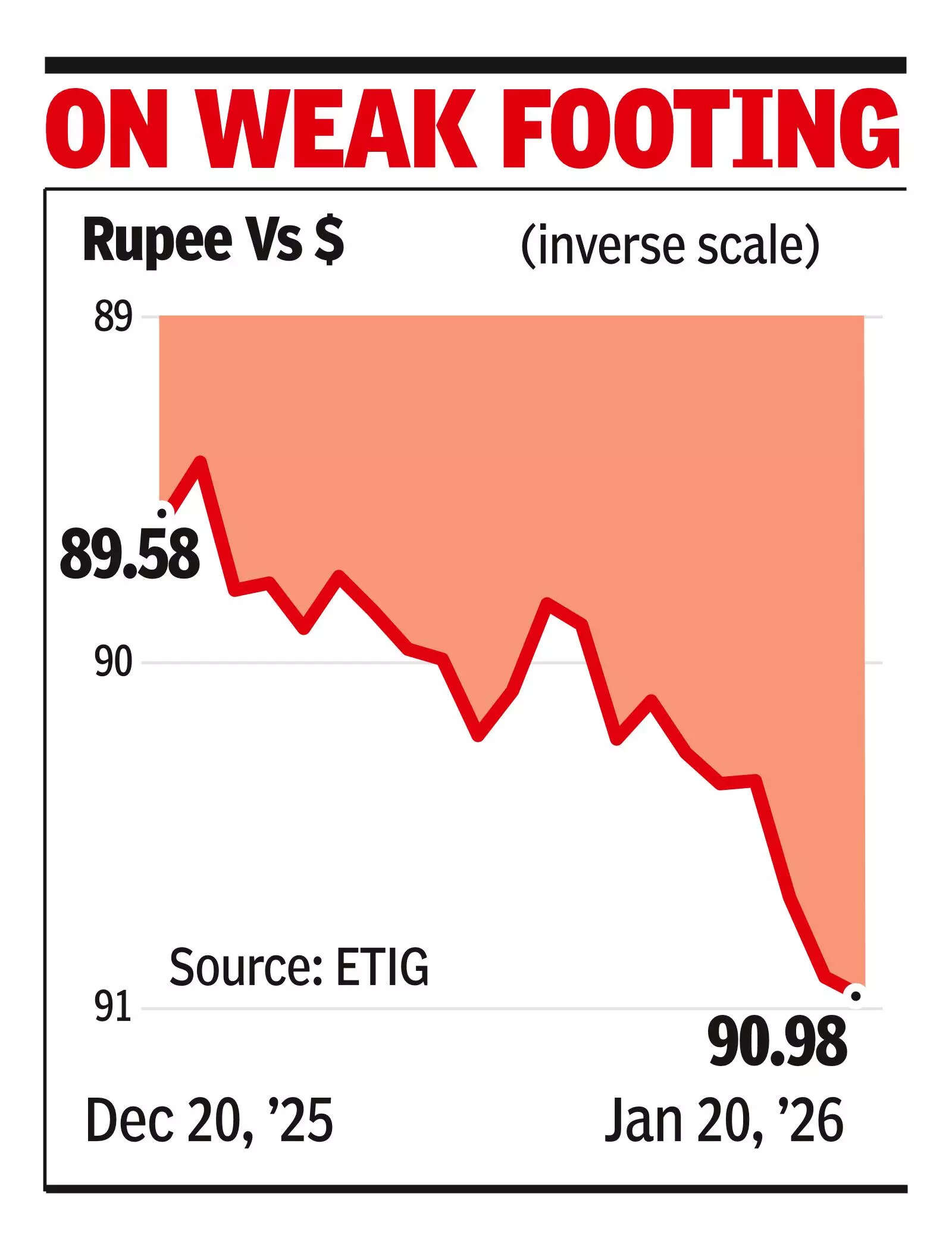

MUMBAI: The rupee weakened for a fifth consecutive session on Tuesday, closing at 90.98 to a dollar, down 7 paise from the previous session, after breaching the 91 mark and sliding to a one-month low intraday amid rising geopolitical tensions and sustained selling in domestic equity markets.The currency opened marginally weaker and slipped to 91.05 per dollar during the session, nearing its all-time low of 91.08, before recovering slightly. Over the past five sessions, the rupee has depreciated by about 1%, reflecting persistent dollar demand and a risk-averse global environment, though it avoided setting a fresh record low.

Sentiment was further weighed down by equity market weakness, with Indian stocks underperforming other emerging markets. While MSCI’s emerging-market index rose more than 30% last year, marking its strongest advance since 2017, domestic equities have lagged, adding pressure on the currency.Dollar sales around the 91 level helped pull the rupee back from near-record lows, with market movements indicating efforts to prevent a breach of the all-time low. Similar support was evident in earlier sessions, which limited the extent of depreciation despite continued outflow pressure.“The rupee traded flat near 90.90 level as geopolitical tensions among Nato members and uncertainty around US interests in Greenland, driven by its rare-earth resources, kept market sentiment cautious,” said Jateen Trivedi, VP LKP Securities.Global uncertainty, including renewed geopolitical and trade tensions involving the US and Europe, also contributed to pressure on the rupee.