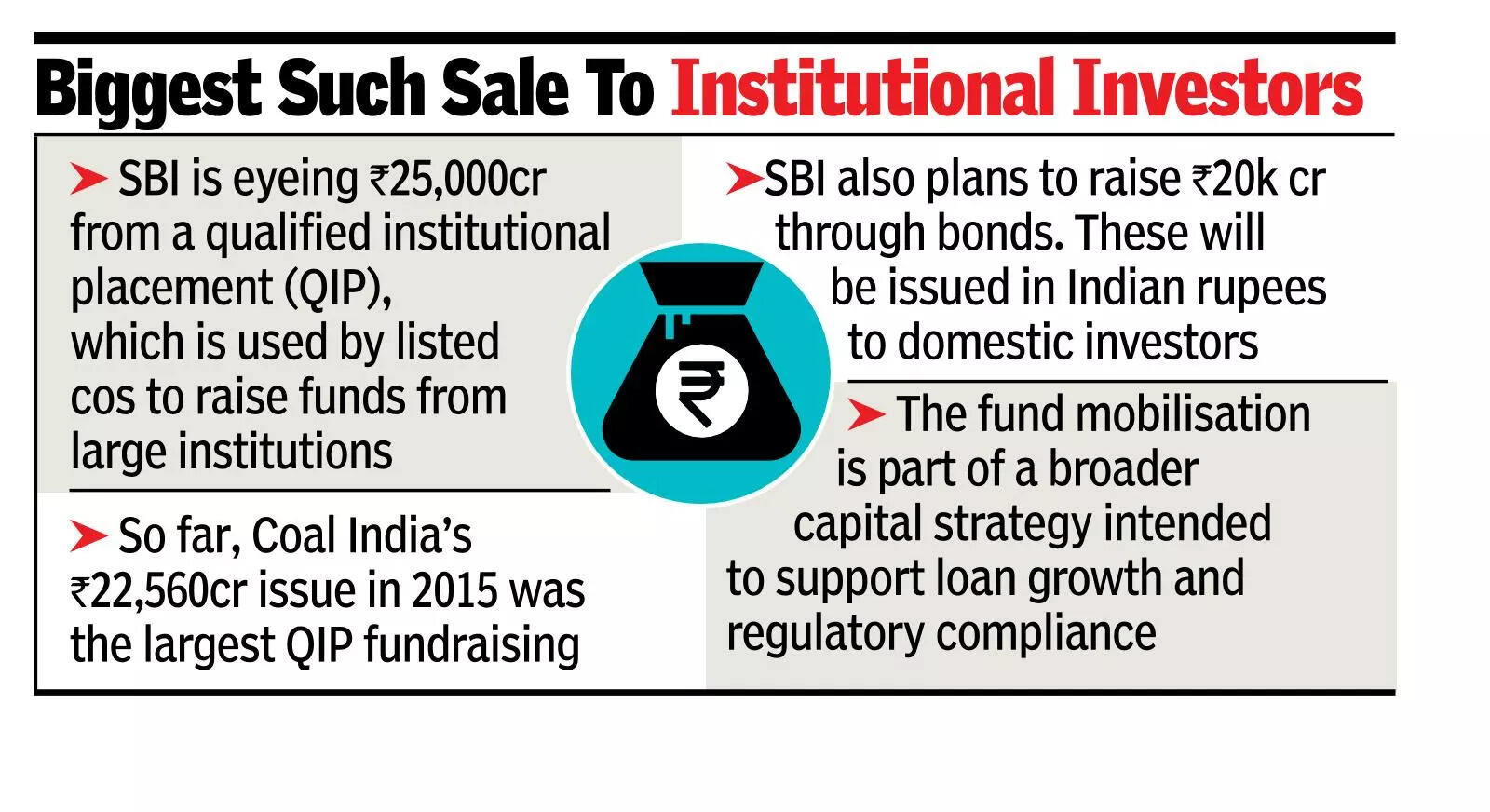

MUMBAI: The country’s largest lender SBI is set to raise Rs 45,000 crore from the capital markets. Of this, Rs 25,000 crore will come through a qualified institutional placement (QIP) this week, making it the largest equity issuance of its kind in the Indian market. Given the current market cap of nearly Rs 7.4 lakh crore, the issue would result in an equity dilution of 3.3 per cent.The bank opened the share sale on Wednesday after securing board approval on May 3 and shareholder consent on June 13. The shares, with a face value of Re 1, will be issued in line with the SBI Act and its General Regulations. Coal India’s Rs 22,560 crore issue in 2015 was, until now, the largest equity fundraising through QIP. SBI’s placement will exceed this if fully subscribed.The floor price for the offer is set at Rs 811.05 per share, calculated under Sebi’s pricing formula. The bank may offer a discount of up to 5 per cent on this price. The final price will be determined in consultation with the book-running lead managers. The pricing is based on the relevant date of July 16.

SBI has filed a preliminary placement document with BSE and NSE. The offer is restricted to qualified institutional buyers. The bank has closed its trading window for designated persons under its insider trading code. In addition to the equity offering, the bank plans to raise Rs 20,000 crore through bonds compliant with Basel III norms. These will be issued in Indian rupees to domestic investors. The plan is subject to approvals from the govt where applicable. The bank will raise the bond capital in tranches, depending on market conditions. AT1 bonds will support Tier 1 capital, while Tier 2 bonds will boost overall adequacy.The fund mobilisation is part of a broader capital strategy intended to support loan growth and regulatory compliance. In its Q4 FY25 earnings call, the bank noted a capital adequacy ratio of 14.3 per cent, above the regulatory threshold. Though it earlier said it did not require fresh capital, the decision now appears driven by favorable market conditions and expected credit growth of 12-13 per cent.