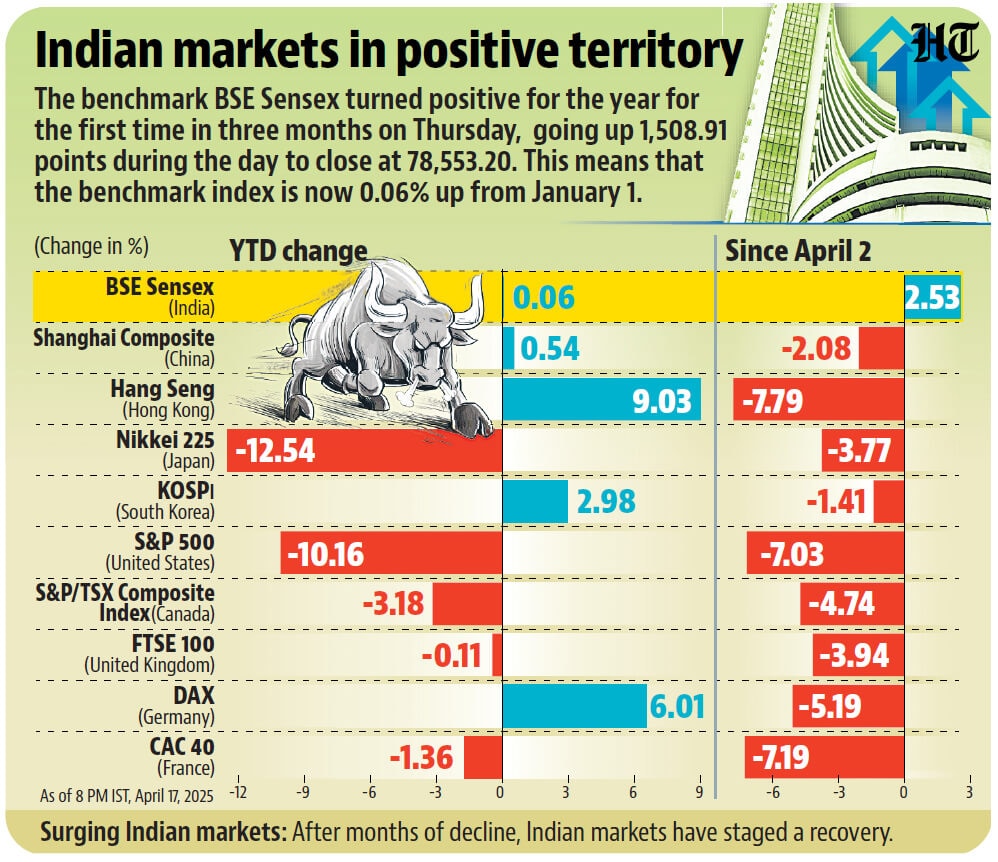

NEW DELHI: The benchmark BSE Sensex turned positive for the year for the first time in three months on Thursday, April 17, going up 1,508.91 points during the day to close at 78,553.20. This means that the index is now 0.06% up from January 1.

After months of decline driven by foreign investor selling, weak earnings, and global headwinds, Indian markets have staged a strong recovery in recent sessions.

On Tuesday, the Sensex became the first major global index to recoup losses from Donald Trump’s April 2 tariff announcement.

Banking stocks have powered the rebound, supported by cooling inflation, favourable monsoon forecasts, and prospects of deeper RBI rate cuts.

Additional momentum came from Trump’s tariff relief on tech goods and a potential pause on auto tariffs. Banking stocks have now gained 6.3% this year.

To be sure, while Indian markets were thefirst to recover from Trump’s tariff-induced rout, other markets also show positive year-to-date returns.

In Asia, benchmark indices of Hong Kong, South Korea and China are up 9.03%, 2.98% and 0.54% respectively. In the West, Germany’s DAX has gained 6.01% for the year at the time of press. However, major markets including the US, Japan, UK and France are still reeling from the ongoing trade war.

A key factor in the recent market rebound is the return of foreign institutional investors (FIIs), who had been selling consistently through April until Tuesday.

In just the past three sessions, FIIs made substantial net purchases of ₹6,065.78 crore, ₹3,936.42 crore, and ₹4,667.94 crore respectively in the cash market.

Analysts attribute this shift to markets having fallen too sharply in previous months, with hopes of easing global trade tensions triggering short-covering — as investors who bet on falling prices rush to buy shares to limit losses when markets start rising. This activity, combined with renewed foreign investor interest and improved outlook in select sectors, has fuelled the recovery.